Blog

Understanding CA Form 540: California’s State Tax Form

If you’re lucky enough to live or work in California, you’ll know that its nickname of “the Golden State” is well deserved. However, you’ll also…

Understanding IRS Tax Code 570 and What It Means for You

Once you’ve filed your tax return, you’ll want to know when it’s going to be processed and finalized, and most of all, when you’re going…

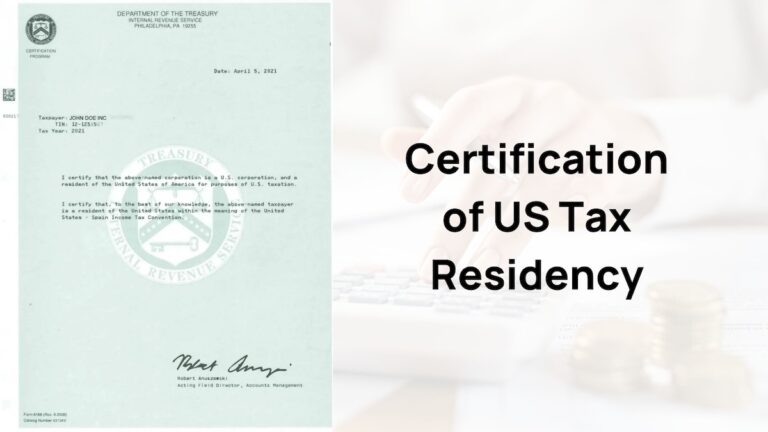

Form 6166: IRS Tax Residency Certificate and processing time

If you are a US resident or business who works or does business abroad, taxes can become even more complicated than normal. While it is…

How IRS Power of Attorney Works (and the Best Way to Submit Form 2848 to the IRS)

Learn everything you need to know about how, when, and why you should appoint a professional as your IRS power of attorney. Having tax debt…

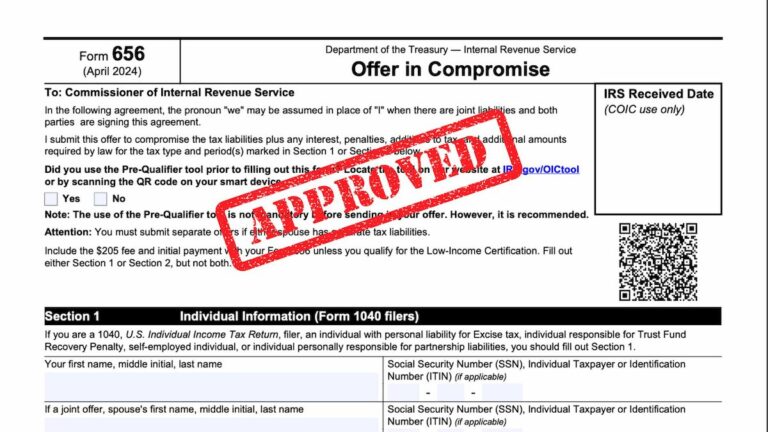

Form 656, Offer In Compromise: What It Is, Who It’s For, and How to Submit an Offer

If the IRS has sent you a tax bill that you cannot afford to pay, you may have heard about Form 656, Offer in Compromise…

How Much Should I Offer In Compromise To The IRS?

If you have a tax debt you cannot afford to pay, you may have heard that it’s possible to reduce your total tax liability with…

Can You Buy a House if You Owe Taxes to the IRS?

If you’re thinking about buying a house, you’ll know that your finances are about to be heavily scrutinized. And if you have outstanding tax debt,…

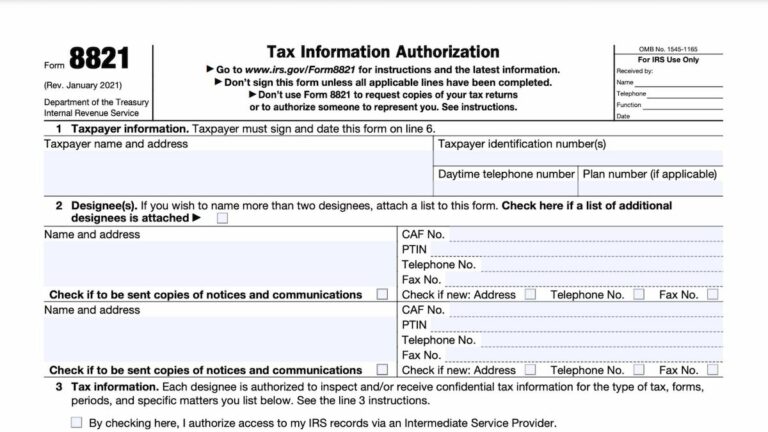

IRS Form 8821: What It Is and When to File It

Knowing which IRS forms to use and when is just one of the many challenges people face with their federal taxes. It’s for this reason…

Will I Get IRS Tax Debt Forgiveness After 10 Years?

If you have IRS tax debt you can’t afford to pay, you’ll no doubt have been trying to find out what your options are. You…

Amend Tax Refund: Track Status and Processing Time

If you realized you made an error on your original tax return and submitted a Form 1040-X to amend it, you might now be wondering…