IRS Tax Forms

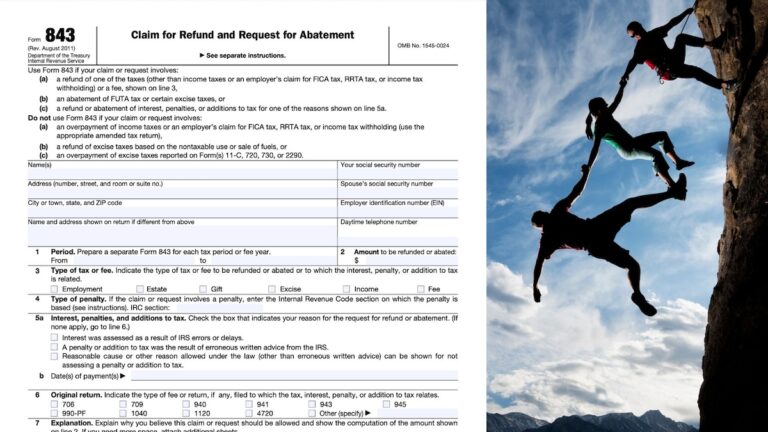

Claiming Penalty Abatement with Form 843

If you’ve received an IRS penalty and believe it was unfair or unavoidable, you may be eligible for relief through IRS Form 843. Here we…

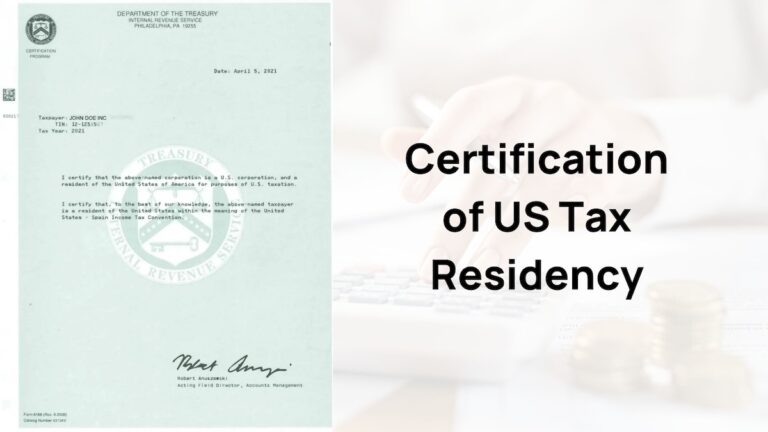

Form 6166: IRS Tax Residency Certificate and processing time

If you are a US resident or business who works or does business abroad, taxes can become even more complicated than normal. While it is…

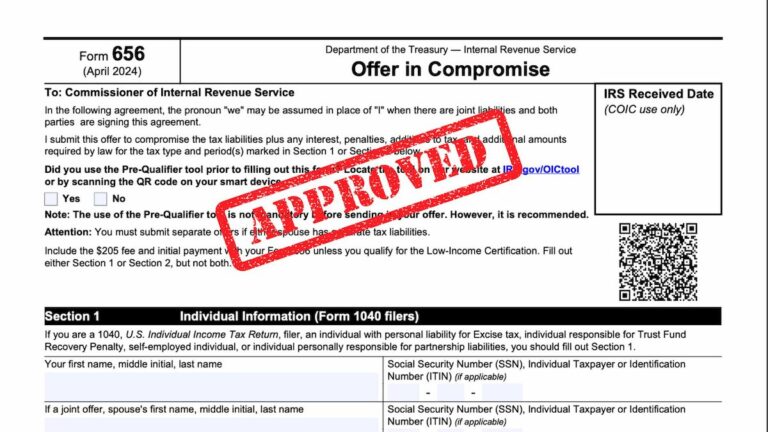

Form 656, Offer In Compromise: What It Is, Who It’s For, and How to Submit an Offer

If the IRS has sent you a tax bill that you cannot afford to pay, you may have heard about Form 656, Offer in Compromise…

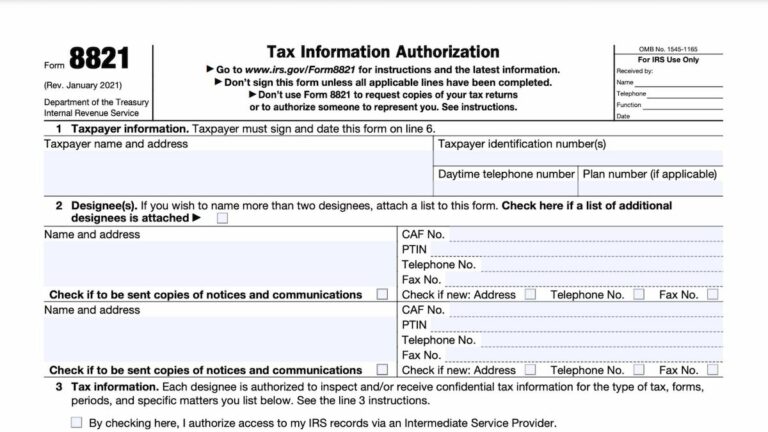

IRS Form 8821: What It Is and When to File It

Knowing which IRS forms to use and when is just one of the many challenges people face with their federal taxes. It’s for this reason…