Blog

Can You Buy a House if You Owe Taxes to the IRS?

If you’re thinking about buying a house, you’ll know that your finances are about to be heavily scrutinized. And if you have outstanding tax debt,…

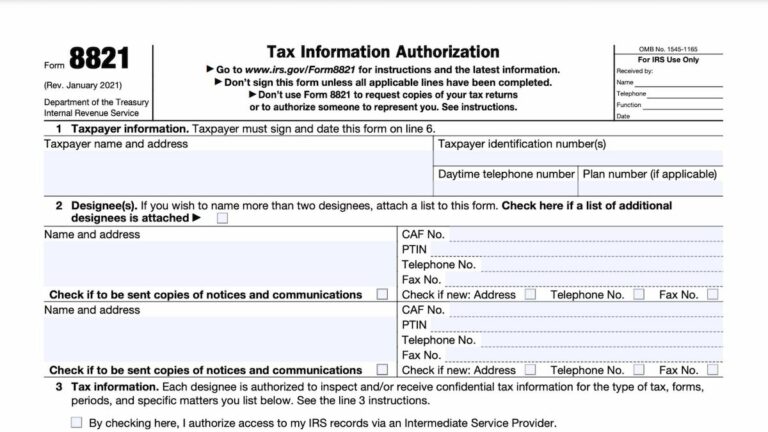

IRS Form 8821: What It Is and When to File It

Knowing which IRS forms to use and when is just one of the many challenges people face with their federal taxes. It’s for this reason…

Will I Get IRS Tax Debt Forgiveness After 10 Years?

If you have IRS tax debt you can’t afford to pay, you’ll no doubt have been trying to find out what your options are. You…

Amend Tax Refund: Track Status and Processing Time

If you realized you made an error on your original tax return and submitted a Form 1040-X to amend it, you might now be wondering…

1065 Late Filing Penalty and Your Options

There are many requirements when it comes to submitting information to the IRS, and if you neglect to do this properly, you face penalties. These…

IRS Notice of Intent to Offset: Meaning & How to Respond

Receiving a letter from the IRS is always a little scary, especially if you weren’t expecting it and don’t fully understand what it means. If…

Tips to Stop Wage Garnishment Immediately

Wage garnishment is a stressful experience faced by many individuals encountering tax debt. When you do not pay your tax debts, the IRS can take…

What Does an Enrolled Agent Do, and How Are They Different from Tax Attorneys and CPAs?

Taxes can be confusing at the best of times. But if you have complex tax returns, tax debt, or other tax resolution needs, that confusion…

Am I Responsible for My Spouse’s Debt Filing Separately?

Married couples have the choice of filing separately or jointly when it comes to their federal income tax returns. The vast majority of married couples…

What Happens if the IRS Sends You to Collections?

If you can’t afford to pay your tax bill, it might be tempting to ignore it in the hopes that it will just go away.…