Tax Relief Programs

Understanding Tax Penalties: How to Avoid or Reduce Them

Written by: Thomas BrooksPublished: March 17, 2025 Understanding Tax Penalties: How to Avoid or Reduce Them Tax penalties can be a costly and frustrating experience…

How to Qualify for IRS Tax Forgiveness Programs

Written by: Thomas BrooksPublished: February 3, 2025 How to Qualify for IRS Tax Forgiveness Programs If you’re struggling with tax debt, you may be eligible…

What Is the IRS Fresh Start Program Application Process?

If you’re looking for help with tax debt you can’t afford to pay, you’ve probably come across the “IRS Fresh Start Program” and are wondering…

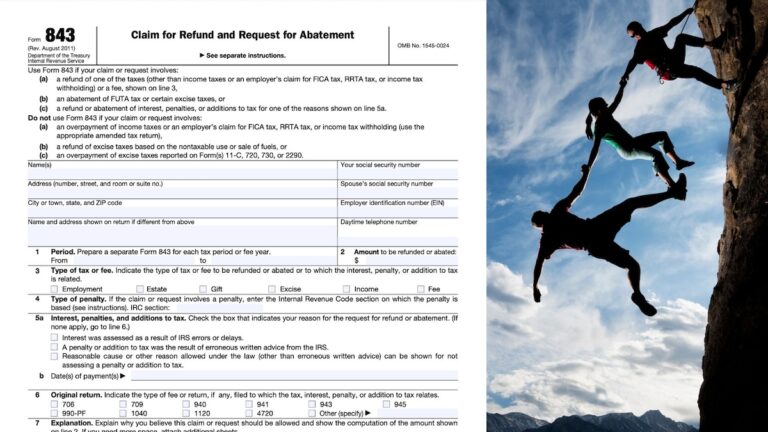

Claiming Penalty Abatement with Form 843

If you’ve received an IRS penalty and believe it was unfair or unavoidable, you may be eligible for relief through IRS Form 843. Here we…

Understanding Tax Debt Abatement Programs: A Guide to IRS Tax Relief & Abatement

When suddenly facing tax debt, it’s not uncommon to wonder if there have been mistakes in your tax assessment or to feel that the penalties…

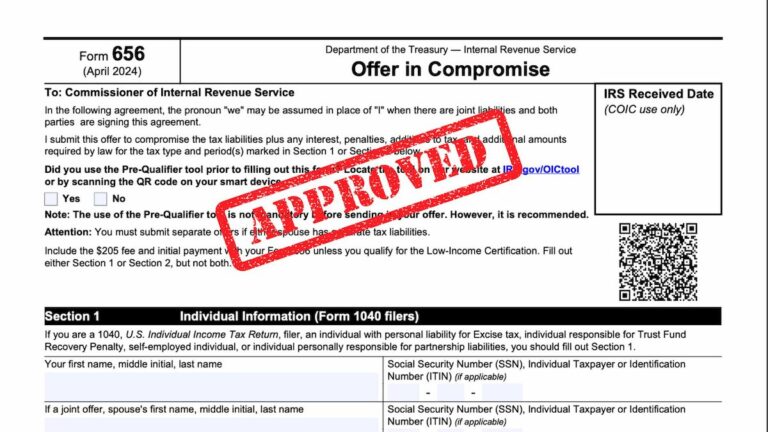

Form 656, Offer In Compromise: What It Is, Who It’s For, and How to Submit an Offer

If the IRS has sent you a tax bill that you cannot afford to pay, you may have heard about Form 656, Offer in Compromise…

How Much Should I Offer In Compromise To The IRS?

If you have a tax debt you cannot afford to pay, you may have heard that it’s possible to reduce your total tax liability with…

Can You Buy a House if You Owe Taxes to the IRS?

If you’re thinking about buying a house, you’ll know that your finances are about to be heavily scrutinized. And if you have outstanding tax debt,…

1065 Late Filing Penalty and Your Options

There are many requirements when it comes to submitting information to the IRS, and if you neglect to do this properly, you face penalties. These…

IRS Notice of Intent to Offset: Meaning & How to Respond

Receiving a letter from the IRS is always a little scary, especially if you weren’t expecting it and don’t fully understand what it means. If…